Limited Liability Partnership, commonly known as “LLP”, is a newer form of business in India with limited liability benefits of a private limited company and the flexibility of a partnership firm. The concept of the LLP was introduced in India in 2008 and is regulated by the Limited Liability Partnership Act, 2008.

The maintenance cost and compliances are less in LLP; hence, it has become a preferred form of business organization among entrepreneurs. This form of business structure is ideal for small and medium-sized businesses.

It is easy to start and manage a Limited Liability Partnership in India. A minimum of two partners are required to register an LLP, and there is no upper limit. The LLP Agreement governs the rights and duties of the designated partners. They are directly responsible for the compliances and all the provisions specified in the LLP agreement.

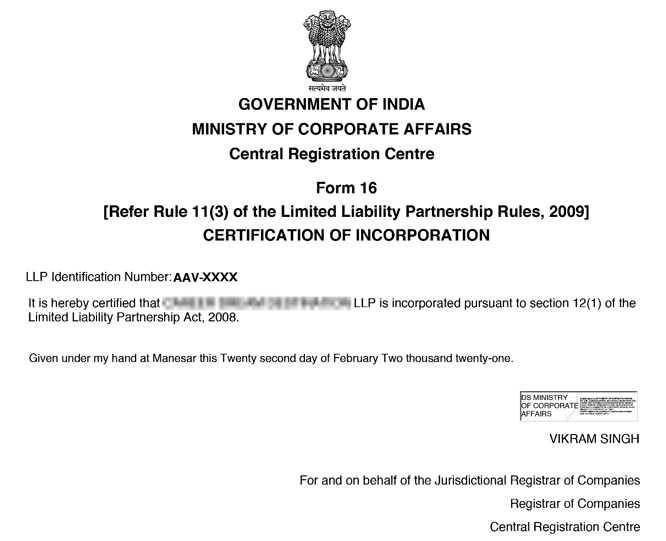

LLP Registration Certificate [Sample]

Following are the advantages of incorporating an LLP in India:

Following are the requirements for incorporating an LLP in India:

The step-by-step procedure of LLP registration in India is as follows:

The first step of LLP registration in India is applying for the digital signature of all the designated partners of the proposed LLP. The incorporation of LLP is entirely digital; all the documents are filed online and must be digitally signed.

Designated partners whose signatures are to be affixed on the e-forms must obtain Class-3 Digital Signature Certificates from government-recognized certifying agencies.

You have to apply for the “Designated Partner Identification Number (DPIN)” of all the designated partners or those intending to be designated partners of the proposed LLP.

LLP-RUN (Limited Liability Partnership-Reserve Unique Name) form is filed for reservation of the name of the proposed LLP. While making the name application, it is recommended that the name should not be similar, identical or phonetically similar to existing LLPs, companies, firms, and trademarks.

You can easily check for name availability using our free LLP name search tool or company name search tool. The system will provide a list of similar or closely resembling names of existing companies or LLPs based on the search criteria.

If it fulfils all the prerequisites, the proposed name of LLP is approved by the Central Registration Centre of the Ministry of Corporate Affairs if found in the ordinance.

The FiLLip form has to be filed for incorporation of Limited Liability Partnership with the Registrar having jurisdiction over the state in which the registered office of the LLP is located. Details which has to be filed in the FiLLip form are:

The Registrar will register the LLP if the documents comply with the LLP Act's relevant provisions. Post-approval of the FiLLip form, Certificate of Incorporation is issued within 14 days in Form-16 from the Central Registration Centre of MCA under the letterhead of the Government of India.

LLP Agreement is the most important document of an LLP that governs the mutual rights and duties of the partners; also between the LLP & its partners.

The incorporation cost of registering an LLP in India, including government and professional fees, is Rs. ₹7,499 Only with Professional Utilities.

| Steps | Cost (Rs.) |

|---|---|

| Digital Signature Certificate | ₹2,000 |

| Government Fee | ₹1,500 |

| Professional Fee | ₹3,999 |

| Total Fee | ₹7,499 |

Documents of both the partners and LLP have to be submitted for incorporating a Limited Liability Partnership:

The expert team at Professional Utilities can help you incorporate a Limited Liability Partnership in India. Register your LLP online in a fast and most affordable manner in three easy steps:

Step 1:

Get in touch via call or contact form

Step 2:

Provide necessary documents

Step 3:

Get your LLP registered in 7-14 days

The LLP formation process takes around 10 working days, subject to document verification by the Ministry of Corporate Affairs (MCA).

Following are the documents you’ll receive after registering an LLP in India:

At Liquetax, we leverage our industry knowledge and expertise to help businesses navigate complex regulations, minimize risks, and optimize operations for maximum efficiency and profitability.

The registration fee for LLP companies in Delhi is 7,499 which includes DSC for minimum 2 members, 1 Lakh Authorised capital, Government Stamp duty as well as Professional Fees of Professional Utilities.

To get your LLP Company registration in Delhi, you need to submit all the valid documents, submit govt fees and professional fees,

To register a LLP Company in Delhi you need to provide with some of the basic documents such as Aadhar card, PAN Card, registered office address, DPIN, DSC etc.

The usual time required for LLP company Registration in Delhi is around 7-10 working days, subject to the document validation from the concerned ministry.

Speak Directly to our Expert

Reliable

Affordable

Assured